Archive for the ‘Uncategorized’ Category

Why list on the Frankfurt Stock Exchange with FSE Listings and Issue Bonds versus working with Equity Placement firms or Equity Lines

Initially one needs to understand the cost to a company of taking shareholder equity. By committing to Equity Placement firms and or Equity Line holders shares of the firm, you are giving them a direct claim to your firms profits proportionate to their investment and holding of your firm. Therefore, you as a company need to consider:

The Real Cost Of Money – The cost of issuing shares is higher in the long-term than that of developing a debt instrument such as a bond. For example, the limitation of a Bond with a 10% yield, a shareholder is limitless based on a portion ownership of your firms growth. A Bond may be over 5 years, and the capital invested increases your capacity by 50%, so the funds in place are justifiable for the coupon payment of 10%. After 5 years, your firm earns all the profits of the decision made. With shares and shareholders, as long as there are shareholders, they have a right to the profits of the company ongoing. Often companies underestimate the real costs to gain the shareholders, which are in short the immediate and ongoing cost of legal, accounting, financial advisory, governance and corporate professionals such as brokers, bankers, and sponsors. In the current markets, these costs can absorb up to 50% of funds raised in an IPO, and sometimes they are costs that exceed the capital raised directly related to their services. Often, after the exercise of writing a prospectus and preparing your firm to raise capital, the capital raising in the private equity market depends on your ability to help raise money and pay attention to the shareholders and potential investors to gain the investment. The time consuming exercise deteriorates even some of the strongest businesses as the focus is on capital and not the company management and profitability during that timeframe. This is a high cost.

Loss of Control – The Company loses control to make decisions as it is required to consult with the shareholders of the Company. This is a difficult choice for entrepreneurs, and it is even more difficult when trying to set the today value of the dreams, aspirations, and blue sky of a firm to an investor. Often private equity involves losing more control than debt of the operations and decision making of a company.

Downward Pressure on the firm’s value – Go public and merger law related firms, or firms who offer equity lines of credit, convertible debentures, and private placement services at a discount of your share price create pressure on your stock and companies value. Especially the Bridge Loan programs for listing on the Frankfurt Stock Exchange, whereby they take their 5% of the shares and sell them into the market or at a discount to shareholders who liquidate based on emotion as they have no relationship with your firm and its success. Equity line firms strive on being issued shares for no upfront cash over a 15 day period or more so that they can sell shares into your market pushing down the stock value and bid so they can make more profit, of up to 50-90% in some cases. These PIPEs, Debt Financing, and special purpose private equity placements are toxic to companies who want to raise additional capital as their company value is driven down to pennies and control is ultimately diluted both in voting power and in their ability to raise and attract interest of capital. Beware of the equity partners and capital firms who offer Equity Lines, Private Placement, Bridge Capital, and Financing options prelisting of your firm. The most illiquid moment of a company is prelisting, and therefore, the owner of such a document actually has control of your firm before giving you a dime. The ability to apply pressure to anyone’s share price in our opinion is the ability to control someones firm. Bridge Loan (Sharks) and joker brokers who assist firms who do not have the 60k euro to list on the Frankfurt Stock Exchange prey on unsuspecting firms for their 5%+ of your deal and reputation to take advantage of your firm once it is listed. Don’t fall into the penny stock pump and dump scenario by avoiding these kinds of partners from the beginning. In addition, these firms may disguise their tactics by promising stock promotions of which you will be able to liquidate your shares and or your shareholders will be able to liquidate their shares into a vibrant market. We receive 5-10 phone calls per week from these types of stock promoter and bridge capital firms who are trying to sell their shares privately and exit the company. Their interest is not in your firm or your share price, its exiting their position. Be vigilant about who you choose as your partners, and before you choose anyone, get the advice of FSE Listings Inc as to their professional reputation by contacting www.fselistings.com.

Effects on the Balance Sheet and Financials

Dividends are paid from after-tax earnings, bond payments and interest payments are tax deductible. This affects the relative costs to the company of financing by issuing interest-based securities and financing through ordinary shares.

Everyone always thinks about listing a firm and raising private equity capital, however, public company shares are just the ability to offer shares and liquidate shares in a public arena. Thus, it gives a cash flow value to the shares of the company. Unlike private company shares that generally have no cash flow value. By listing your firm on the Frankfurt Stock Exchange, your shares have cash value to insurance firms and debtors, who will develop a corporate securitized bond collateralized by the cash flow and assets of the company.

The Benefits of the Bond and Frankfurt Listing:

- No loss of control

- Interest and Coupon Payments that are tax

deductible, not from after tax earnings - Limiting the claim to the companies prosperity

to rate of interest or coupon payments versus a shareholder claim of the

profits (the true cost of money) - Access to the full amount of capital required

- No downward pressure on your share value or

market

If an investment in your firm could double capacity or greater over the next 5 years projections of your firm, you should be considering building a Bond and Frankfurt Listing with FSE Listings Robert Russell, Russell@fselistings.com. Contact us to see if you qualify by filling-out our documents and obtaining a

free pre-valuation of your firm!

Listing a firm on the Frankfurt Stock Exchange takes 3-6 weeks, qualifying for bond issuances takes 2-4 weeks, within 10 weeks you could be a listed and funded firm on the FSE! Don’t hesitate to contact the top listing firm for foreign firms outside of Germany like yourself!

FSE Listings Inc assists 11 firms in going public in the month of October from Frankfurt Listings to Frankfurt Shells for Sale

FSE Listings Inc is proud to have assisted 7 companies this month, with 6 more already submitted this first week of November, we expect to list over 10 new companies in November. When we say companies, we mean firms with operations not just shells.

Within October we managed to introduce 4 shell transactions successfully as one of the leading sources of Frankfurt Shells for sale. If you are interested in purchasing a Frankfurt Listed Shell contact shells@fselistings.com. The current going rate for Frankfurt listed shells for sale is 100k euro.

Thus, in October, FSE Listings Inc assisted over 11 firms in going public on the Frankfurt Stock Exchange!

If you are interested in going public by listing your firm, please fill in the information to see if you meet the requirements by clicking here “Submit Your Company” for a free evaluation.

If you are simply looking for a Frankfurt Listed Shell for Sale, contact our Frankfurt Shells department, shells@fselistings.com

For an export of our website content, please click here: FSE Listings Website Content

FSE Listings: How to list your firm on the Frankfurt Stock Exchange for the greatest success for your Frankfurt Listings

With stock market experience going back as far as the 1980’s, our management team have seen their fair share of success stories and disasters in financial markets. My mother once told me, if you don’t have something good to say, don’t say it at all. However, the recipes for disaster have usually been associated to individuals and companies looking to go public with fse listings now but are not prepared. Preparation is more than just documentation, it is knowing what you want to give up, and what you don’t want to, and understanding the cost of money and decisions now and in the future. Sounds pretty general, but let me get really specific:

- Don’t give equity in your firm to individuals who claim they will list your firm with bridge capital, make it debt not equity. If you allow equity to a listing firm, its for selling, and this can push your stock price below the value to enable you to raise capital. So the hint here, is accept debt, but not equity.

- Do not go into Equity Lines of Credit that promise to give you money after listing. After listing is the most illiquid moment in time for any public company, if you need money, Equity Lines are not the way to go. If you just listed, again, you want to leverage your stock for debt instruments as collateral that does not get sold. Many of these so called “Equity Lines” or “Special Options” are based on VWAP, volume weighted average pricing based on the lowest bid. In addition, they get your stock to sell, averaging out 40-70% commission for them when hitting the bid of your firm. Some say they will give you a floor, but that’s a trick. Because a floor means they don’t have to pay you once they hit the floor, so no money. The whole exercise again is about you giving away equity that hurts your market. Equity Lines of Credit kill your business and market. Don’t do equity lines of credit, they are another example of giving away equity in early companies. If you have a company trading in excess of 100,000 shares a day, possibly it could work for your firm, but don’t sign anything until you have a market or you will crush your firm in the wrong hands.

- Do not give out a block of shares to persons who promise to raise money and do stock promotions. This is an oxymoron. Stock promotions generally increase the float of your market and put pressure on the stock of the company. Most of these going public, merger law, types actually over charge for listing costs which is between 60-75k, without ever completing their services as a promoter. In the finance world it’s the sour thumb approach, or pain in the back we call it, where they have taken 5% or more of your firm without producing much more than the listing, with no pressure to complete the raise of funds, and in essence these culprits leak shares into your market making it weak and volatile until you simply make them an offer to buy them out, or continue to suffer into failure. Most of these are bridge capital offers, and place you in an unfair position of pushing uphill your own stock and capital markets as a group so they can make a profit for very little and cause the downhill capital pressure.

The best way to list your firm on the Frankfurt Stock Exchange

You are probably asking yourself, what do I do now that FSE Listings Inc has told us, don’t use firms who offer bridge capital for equity (contact me if you don’t understand why yet at info@fselistings.com), don’t give away free stock to promoters, don’t use equity lines of credit on new or unlisted firms, don’t give blocks of shares away unless you are getting paid, try your best not to “Give Up Equity” in the beginning of starting your firm, and try to restrict current shareholders until 6-12 months after listing if at all possible.

I am glad you asked, because it’s going to seem so easy, you will wonder why everyone doesn’t list with FSE Listings Inc. when the entire market knows what the competition does to unsuspecting entrepreneurs like yourself.

- Build a corporate structure that has the right articles to protect the control of your firm, gives the leverage to issue ordinary shares, restricted shares, preferred shares, bonds, etc.

- Pay the costs of listing or borrow the funds as debt, but do not give up any equity to anyone unless its capital in the Bank. There is a cost to money, if your firm is going to be a 50 million euro firm, 5% is 2.5 million euro… and there needs to be that much buying to keep a stable stock price. So… borrow the money, don’t give away bits of your firm unless it’s for 2.5 million euro in cash.

- Put together with Deutsche Capital Partners AG a series of stock options for example par value of 0.10, 0.20, etc. Have them prepared for the purpose of raising capital for the company, and have them approved by the Board.

- Complete an IM or Prospectus if you would like to use the Options method

- Fill-in the Deutsche Capital Partners Client Questions, supply the business plan, and financials to qualify for corporate bonds to raise capital. (No prospectus required for the Bonds which are 125k euro per unit.) Bonds are debt versus equity! Keep control of your firm.

- Utilize the Frankfurt Stock Exchange Listings recommended market maker for ensuring that your market has awareness and daily trading volume in Units to ensure it meets the market requirements.

- Possibly look at different classes of shares, such as 12-24 month restrictions for start up firms, for current and future shareholders to avoid “emotion” driving your initial market listing pricing and corporate valuation

- Launch the FSE Listings Inc lead generation and investor relations program if you are raising capital based on the IM

- Launch the Private Growth Share Vision report and promotions, Roadshows, and institutional financing campaign for the Bonds

- Utilize the Bond financing to make further acquisitions and grow your firm, all available because you have built a Frankfurt Listing with FSE Listings Inc.

If you follow our advice and work closely with FSE Listings Inc and its consortium to deliver the services above, your firm should be able to raise anywhere from 1-300 million euro, maintain control of your firm and the public listing, not have to worry about people selling Frankfurt listed shares they received for services into your healthy vibrant trading public company, but rather paying back bonds and funds to have complete control of your firm when you go public successfully. Become a public company success story on the Frankfurt Stock Exchange.

I would advise listing with FSE Listings Inc by contacting the listings specialist Robert Russell, Russell@fselistings.com.

FSE Listings Inc launches new ShareVision Report for clients to be able to identify shareholder

remuneration and gain interest from FSE’s $100 billion fund network and Roadshows!

This new service is applicable to Banks, Fortune 500 companies all the way to the common small business with cash flow.

FSE Listings Inc’s with a private growth professional consortium assist in the valuation and key services to FSE clients which want to gain exposure to a USD 100 Billion funding network in order to raise the profile of the companies. Our consortium consultants have advised clients valued at over $120 billion, providing key services as well as working closely with select high-net worth private clients.

FSE Listings Inc does not just list firms onto the Frankfurt Stock Exchange, our Private Growth consortium provides valuable insight and research into the industries and companies we work with to give share value and share vision for shared results to the members of your firm. In today’s economy, a financial audit is a 1 dimensional perspective of a firms potential performance. When we audit a firms performance, the value is in the Brand, the Business Growth and stages of development, the Directors and Management creativity or leadership, staff moral and motivation or productivity, the competition, and the bottomline.

What can the ShareVision analysis do for your firm, ask CEO’s that have worked with our partners:

“Your circle is invaluable and should be compulsory for all executives of companies who genuinely want to take their business to the next level”

“We (major public company) found ShareVision very helpful and would like to use your services going forward”

CEO (multi-national firm) “Your services are very professional.”

The ShareVision process is the most complete analysis available on the market of the internal share value of a company, and the most reliable report one can achieve for valuation of a firm and projections for finding funding and building the business. Sharevision works for existing public companies, the top 500 biggest firms in your Country to any public company in general. The reality is, we have taken over 30 years of valuations services to large corporations, utilized by Blue Chip firms for billions of dollars in financing and enabled a low cost entry level for new and current Frankfurt Listings to take advantage of. Our Private Growth partners have worked with Banks, Marinas, Hotels, Energy Companies, Construction firms, National Companies, Public Companies, and private firms.

Our report is unlike any other service, it doesn’t compete with current consultants within the Go Public market, it compliments their services and recommends how to best take advantage by a 360 degree review of the firm. The scope is to independently and confidentially assess the shareholder wealth created by existing corporate advisors, management, and other value contributors into a bankable report. By recognizing how shareholder value directly affects renumeration, a strategy and direction can be put in place to guarantee insurable returns on investment and encourage a network of over $100 billion in funds to look at your business. What if your firm doesn’t qualify, the point of the report is to fine tune the business so it can qualify for financing or point out the strength’s where the firm does qualify and can take advantage of growth.

Corporate advisors need to maintain their independence and objectivity, they are not capable of preparing the true ShareVision report of which a firm such as our consortium is capable of.

Our objective second opinion is also a report that can be revised to encourage the public and your shareholders. In summary, our experts will assist with:

- Valuing your company (true worth, not distorted by various market perceptions)

- Increasing your company’s share value and share price

- Increasing sustainable earnings

- Increasing brand value

- Providing greater performance flexibility for directors and management

- Increasing staff moral, motivation, and productivity

- Prioritizing projects, acquisitions, strategies by greatest increase in sustainable earnings and share price

- Justifying benefits of additional or reduced loans, by assessing the optimal loan amount to leverage company performance and valuations (without destroying earnings sustainability, pricing competitiveness and company value. This may be leveraging the FSE Listings Bond services and other sources.

- Attracting private equity funds by offering potential investors an independent assessment of company value and future earnings and share price performance

FSE Listings Inc is a full service global consulting firm specializing in listing companies, analyzing companies, public relations, mergers and acquisitions, financing, and growth of public and private firms.

If you are interested in a ShareVision process and promotion to our fund network of $100 billion, contact us today and we will begin the orientation for free.

Many firms will pay in access of 50,000 euro’s to gain exposure on the private growth network of over $100 billion in funds, however, we can gain access for firms who work through FSE Listings Inc for much less than half what the fortune 500 firms are charged because you are valued client of the FSE Listings.

Contact us today so we can assess if your firm qualifies for access to the Private Growth network and FSE Listings Consortium.

For listing clients, we have now been able to package the world’s most complete list of services offered to companies looking to list on the Frankfurt Stock Exchange, raise capital, and increase share value:

- Creation of the holding company

- ShareVision Report

- Creation of Corporate Bonds

- Insurance of Corporate Bonds

- Listing the Holding Company on the Frankfurt Stock Exchange in 3-6 weeks

- Investor Relations and Press on major market websites in German and English

- Financing within 60-90 days of listing for qualified firms

Contact info@fselistings.com, the leaders in listing firms and consulting for maximum share value of your

firm! We guarantee our results!

Finding an effective network or strategy of reaching high-net worth investors for exposure to your public company or private firm is often the largest challenge. The internet is one of the liberators to reaching this market and qualifying the eligibility of people prior to solicitation of any kind. Key aspects and components that have allowed up to several $100 million in placements globally:

- Development of an Industry website and qualifying data sheet that meets the jurisdictional definitions of the

“investor” who is allowed to make a placement in your firm Supply of an industry report, information

memorandum, and or summary on the business without direct solicitation, based on an opt-in of interest on your firm - Usage of Google Adwords, Facebook Ads, LinkedIn, Investor Networks, Private Growth, Angel Networks,

- Investor Hubs, and other such networks to find High Networth Individuals (HNIs) Public relations exposure on an extensive global network for press releases, and appropriately placed contact details for filling in forms on the companies website or a script for investor relations or corporate representatives to pre-qualify those contacting the company

- Investor Forums, Interviews, and Web Casts that drive potential shareholders to assert their interest in the industry and the firm

- Access to newsletters and opt-in emails

- Direct contact that encourages individuals to take initiative and qualify themselves through a web interface for receiving information and self-certifying their eligibility

Suppliers of reports have their own networks, thus, they often drive an additional following to your company.

Ensure your firm is always trying to collect data on all persons who contact the firm, regardless if they are an investor or not, qualifying them helps mitigate problems that could occur if unqualified individuals make an investment from talking to your public company or employees. Knowing they are certified increases your confidence as a company in what you share and can share as far as company information and opinions. Knowing increases your ability to attract the investment!

If you would like to build a qualified investor database or develop an interest in your firm from sophisticated investors, you should be looking at the Online Qualified Investor marketing program and Social Media

Marketing campaign. The quality of the clients attracted to your firm, one lead could more than pay for the cost of a campaign!

Contact Cameron@FSElistings.com, Cameron Brady Frankfurt Stock Exchange Investor Relations!

FSE Listings: Looking for the best way to raise acquisition financing to purchase a cash flow business?

Looking for the best way to raise acquisition financing to purchase a cash flow business? You need a Frankfurt Stock Exchange listing and a securitized bond will help you make the acquisition.

Four Easy Steps to Acquisition Capital:

- Firstly, you create a Frankfurt Stock Exchange listed vehicle with FSE Listings Inc’s exclusive specialists in the field of mergers, acquisitions, and financing on Frankfurt. The public company is listed within 3-6 weeks.

- Secondly, you identify the asset company or cash flow based business and their cash flow requirements, for example 1-5 million euro of which possibly 1 million euro buys-out control, the remainer is for expansion.

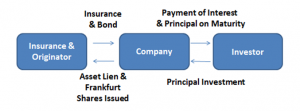

- Thirdly, the FSE Listings team takes the listed stock, a lien on the acquisition target assets and cash flow, and creates a securitized bond with an originating firm for this type of security.

- Fourthly, the bonds enable the 1-5 million euro capital into the company as investment and for the acquisition of the target business.

The merger and acquisition is completed in 4 easy steps in an average of 10 weeks.

FSE Listings Inc merger law and acquisitions strategies enable leading edge products to be offered from an experienced team. Don’t hesitate to contact us today! Info@fselistings.com

Listing on the Frankfurt Stock Exchange and accessing financing through a Securitized Bond Offering

In order to securitized assets, they need to be cash flow producing. Public company shares are considered cash flow producing, in addition, a company’s sales revenue, mortgages, royalties, and payments being made to a company are ongoing cash flow, all which is insurable and bondable. In today’s economy it is not enough just to insure cash flow, securitization generally requires the packaging and pooling of assets to achieve a higher rating acceptable to institutional markets in Europe. Thus, firms listed on the Frankfurt Stock Exchange can utilize their shares and assets pooled into a securitized bond for funding.

The process looks as such:

Frankfurt Stock Exchange Listings are vital for funding the company, without the listed shares, the institutions would not make the investment. The Bond requires both listed shares and the cash flows to give the additional security required to give a AA rating and guaranteed rate of return of 10%.

In addition to the financing required, the firm gains:

- The notoriety of being a publicly listed company

- The funds required to run their business successfully

- Access to additional capital through the public markets

- Entry into institutional investors without a costly Prospectus or IM

- Real capital in 9-10 weeks, not Equity Lines and Pass-Through investments than never formulate

The Costs Involved With The Process

- The company requires up-to-date financials

- A third party valuation

- A listing on the Frankfurt Stock Exchange

- Due Diligence

- The Insurance and Issuance from the Originator

- Capital raised (Optional, as firms can often raise their own)

The cost of these items dictate the cost of the entire process to access up to 5 million euro in financing for your firm.

Companies are required to base their own expense third party valuations, commissions to brokers and the insurance firm, and auditors if required.

Why is this the number one way to finance a firm?

– It takes on average 8-10 weeks

– The company doesn’t dilute itself

– The investment for investors is insured

– All the required capital comes in a single tranche versus overtime

Contact info@fselistings.com or Robert Russell, Russell@fselistings.com to see if you qualify, and what the costs for your firm would be.

Don’t have a project to securitize yet? Don’t worry, list the company first so that you have half of the equation covered, it will make it easier to securitize if you have the ready made public company. Once you have the right target acquisition or revenue streams, create the Bond. This is also a very useful method for acquisition financing.

Firstly, you are paying for a listing on a bona fide stock exchange, not an OTC or Pinksheet listing quotation board, but a Frankfurt Stock Exchange listing.

– In comparison to the OTCBB, listing costs are similar upfront but it takes 3-6 weeks to list a Frankfurt Company, and it takes 12 months for an OTCBB. In addition, a Frankfurt listing is at least $100k cheaper per annum to maintain without the reporting requirements and additional expenses associated to the OTCBB.

– In comparison to TSX (Toronto Stock Exchange), listing on the Frankfurt is $150k – $300k cheaper upfront and $50-$75k cheaper per annum. It takes a minimum of 6-8 months longer to list than Frankfurt Listings.

– In comparison to listing on the JSE (Johannesburg Stock Exchange) listing on the Frankfurt is 240k euro cheaper upfront and over 100k euro per annum cheaper to maintain in our opinion and experience. It takes 18 – 22 months longer to list on the JSE and ALTX.

– The CNSX is roughly $100-$200k more expensive to list when including the broker sponsor. In addition, the yearly costs are $20-$30k more expensive on the CNSX than Frankfurt Listings.

– The ASX (Australian Stock Exchange) is roughly $600k more expensive to list and takes 6-8 months longer than listing on the Frankfurt Stock Exchange, in addition, the requirements are much higher and stringent.

– The London Stock Exchange AIM markets cost between 250k GBP to 500k GBP to list, sometimes even higher, making their listings up to 500k euro more expensive to list than the Frankfurt Stock Exchange listings. Per annum fees are also in excess of 100k euro.

– The NASDAQ listings cost between 1.2 to 1.5 million USD for IPO listings on average and are equally as expensive per annum, at least $400-$500k on companies with multiple transactions.

From the point of view of what FSE Listings Inc has to over, we can list firms in 3-6 weeks on the Frankfurt Stock Exchange from submission, we keep the costs to a minimum, 60k euro, and we can introduce up to 5 million euro first round financing for firms that qualify. The Frankfurt listing doesn’t have the on going costs of Audits, Legal opinions and bills, disclosures, filings, and reporting that the other exchanges have. Most exchanges are not making it easier for small businesses, their idea of quality companies are those that can pay large bills and yearly fees, there is no interest in quality small businesses on the other exchanges. The Frankfurt Stock Exchange is the most friendly market in the World for new businesses and existing businesses looking to raise capital.

In addition, once listed on the FSE, one can always dual list, cross list, or relist on the AIM, OTCBB, TSX,ASX, JSE, etc.

As a consultancy, FSE Listings Inc provides training to clients, coaches clients, and works with them for years not months. We are available for questions at +19146133889 or info@fselistings.com.

FSE Listings Inc guarantees the success of your listing! www.fselistings.com

Contact us with your information!

Please include:

- Company Name

- Contact Name

- Contact Number

- Contact Email

- Amount of Capital invested to date

- Amount of Capital required

- Reasons for wanting to list

- Description of Business

- Website if available

Contact Robert Russell or Mark Bragg today!

Robert Russell Russell@fselistings.com

Mark Bragg Info@fselistings.com

New York: +1-914-613-3889

UK: +44(0)2081235719

Hong Kong: 81753591

In comparison to TSX (Toronto Stock Exchange), listing on the Frankfurt is $150k – $300k cheaper upfront and $50-$75k cheaper per annum. It takes a minimum of 6-8 months longer to list on the TSX aside from their approvals, restrictions, and requirements in comparion to the much easier and friendly Frankfurt Listings.

From the point of view of what FSE Listings Inc has to over, we can list firms in 3-6 weeks on the Frankfurt Stock Exchange from submission, we keep the costs to a minimum, 60k euro, and we can introduce up to 5 million euro first round financing for firms that qualify. The Frankfurt listing doesn’t have the on going costs of Audits, Legal opinions and bills, disclosures, filings, and reporting that the other exchanges have. Most exchanges are not making it easier for small businesses, their idea of quality companies are those that can pay large bills and yearly fees, there is no interest in quality small businesses on the other exchanges. The Frankfurt Stock Exchange is the most friendly market in the World for new businesses and existing businesses looking to raise capital.

In addition, once listed on the FSE, one can always dual list, cross list, or relist on the AIM, OTCBB, TSX,ASX, JSE, etc.

As a consultancy, FSE Listings Inc provides training to clients, coaches clients, and works with them for years not months. We are available for questions at +19146133889 or info@fselistings.com.

FSE Listings Inc guarantees the success of your listing! www.fselistings.com

You are paying for a listing on a bona fide stock exchange when you list on the Frankfurt Stock Exchange, not an OTC or Pinksheet listing quotation board, but a Frankfurt Stock Exchange listing. In comparison to the OTCBB, listing costs are similar upfront but it takes 3-6 weeks to list a Frankfurt Company, and it takes 12 months for an OTCBB. In addition, a Frankfurt listing is at least $100k cheaper per annum to maintain without the reporting requirements and additional expenses associated to the OTCBB. You require GAP accounting, auditted financial statements, and Sarbanes Oxley. You are subject to trading restrictions, reporting restrictions, and even the ability to clear your shares has become impossible for the most part.

Listing on Frankfurt:

– no audit

– no reporting rules

– no insider trading rules

– no restrictions on insiders

If you have cashflow, a company can get 1-5 million euro fast in and it has no shares to sell related to it.

If its a start up company you can generally get $1-$10 million in private placements over a 12 month period, shares restriced for 12 months if you want to .

From the point of view of what FSE Listings Inc has to over, we can list firms in 3-6 weeks on the Frankfurt Stock Exchange from submission, we keep the costs to a minimum, 60k euro, and we can introduce up to 5 million euro first round financing for firms that qualify. The Frankfurt listing doesn’t have the on going costs of Audits, Legal opinions and bills, disclosures, filings, and reporting that the other exchanges have. Most exchanges are not making it easier for small businesses, their idea of quality companies are those that can pay large bills and yearly fees, there is no interest in quality small businesses on the other exchanges. The Frankfurt Stock Exchange is the most friendly market in the World for new businesses and existing businesses looking to raise capital.

In addition, once listed on the FSE, one can always dual list, cross list, or relist on the AIM, OTCBB, TSX,ASX, JSE, etc.

As a consultancy, FSE Listings Inc provides training to clients, coaches clients, and works with them for years not months. We are available for questions at +19146133889 or info@fselistings.com.

FSE Listings Inc guarantees the success of your listing! www.fselistings.com

Loading ...

Loading ...